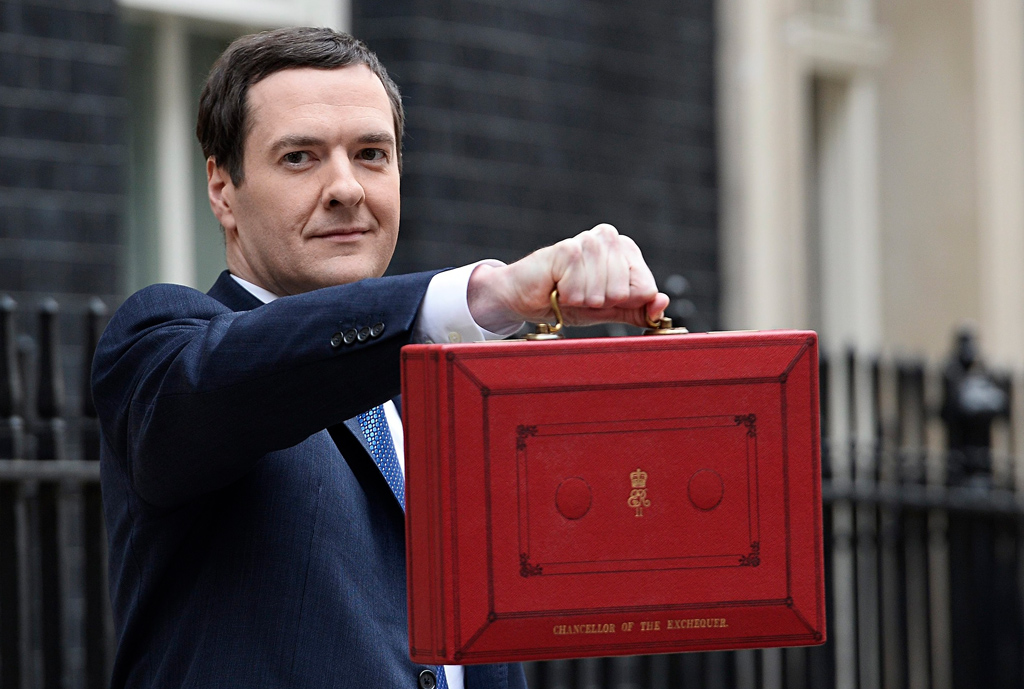

Summary of 2016 Budget

Here as usual is our summary of the main announcements in today’s Budget, with some thoughts and comments to boot.

The build-up to this Budget suggested it could be far-reaching and highly memorable, but in the end it appears that political pressures linked to the EU referendum in June may have got the better of the Chancellor. There was a lot of fluff and not much meat on this Budget.

- The main headlines tomorrow are bound to focus on the new Sugar Tax on sugary drinks (not including fruit juices and milk drinks). This will be introduced in two years’ time.

- The changes to pension tax relief have been postponed, as was reported in the press over the past few weeks. For the first time in a while, pension legislation appears to have been largely left alone. The Lifetime Allowance (of which we are not fans) remains and will reduce from £1.25 million to £1 million in April as planned. Thankfully, the Chancellor explicitly reiterated that he would not be abolishing the pension ‘tax-free lump sum’ (as some commentators had been suggesting, and have been suggesting for some time). The cynic in me says watch out, though: does this potentially sow a seed for its abolition later on?

- Capital Gains Tax rates are being reduced from 28% to 20% for higher rate taxpayers and 18% to 10%, both from 6th April 2016. The old, higher rates will still apply to gains on residential property (too big a cash cow, most likely). This doesn’t appear to affect Entrepreneurs’ Relief (10%), the benefit of ER being that 10% applies on a gain up to £10m whereas the new 10% CGT rate will apply until it pushes the taxpayer into high-rate territory, beyond which they will pay 20%.

- The ISA allowance will rise to £20,000 in April 2017.

- A new “Lifetime ISA” will be launched for people under the age of 40 on 6th April 2017. Put in up to £4,000 a year and the government will add £1,000 (until age 50). It could be used either to buy a first home (at any time after the first 12 months) or provide for retirement (from age 60). Funds should be accessible early subject to having to repay the government bonus plus a 5% charge. The government is consulting on whether to allow people to borrow against the Lifetime ISA, a bit like 401k retirement plans in the US. Help to Buy ISAs can be rolled into a new Lifetime ISA.

- The Personal Allowance (the first part of your earnings which are free from income tax) will rise again to £11,500 from 2017. And the higher rate tax band will be lifted to £45,000 at the same time. As in previous years, anyone earning over £100,000 should be careful though, as you stand to lose part or all of your Personal Allowance. A pension contribution before 5th April could reduce your deemed earnings and attract 60% tax relief.

- Stamp Duty for commercial property will be reformed so as to look more like the new sliding Stamp Duty scale for residential property.

- Stamp Duty on additional properties: this is coming into force on 1st April 2016 as planned. Previously it was proposed that significant investors (with 15+ properties) could be exempt – this has been scrapped. People who buy a home and then sell their main residence will now have 36 months (up from 18) to sell and reclaim the stamp duty.

- Duties: fuel duty has been frozen for the sixth year in a row, tobacco duty will continue to rise ahead of inflation, beer and cider duty has been frozen, scotch whisky duty has been frozen, while all other alcohol duties will rise in line with inflation.

- As ever, there was another attempted clampdown on corporate tax avoidance. Disguised remuneration schemes and multi-nationals attempting to reduce their UK profits were the main targets.

- As in previous Budgets, small businesses appeared to be big beneficiaries, with another reduction in Corporation Tax announced along with changes to small business Business Rate relief.

- There were also a number of new infrastructure announcements, including the green light for HS3 (Manchester to Leeds) and the ‘commissioning’ of Crossrail 2.

So aside from about six minutes right at the end, it wasn’t that exciting. But then I probably should have known that. Hopefully the EU referendum will be more lively.The winners: beer and whisky-drinking small business owners under the age of 40 sitting on capital gains

The losers: over-40 wine and cola drinkers with large property portfolios.

Don’t hesitate to get in touch if you want to discuss any of the above and how it impacts your own circumstances.

Sorry, the comment form is closed at this time.